Vancouver, BC / TheNewswire / April 11, 2024 / Global Energy Metals Corporation TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”), a multi-jurisdictional, multi-commodity critical mineral exploration, development and project generating company focused on growth-oriented projects supporting the global transition to clean energy, announces an exploration strategy for summer 2024 at its Monument Peak Copper-Silver-Gold Project (the “Project” and/or “Monument Peak”) in Lemhi County, Idaho, United States. The project is located east of Salmon Idaho, along the Montana border.

Highlights

- Monument Peak, consisting of 84 claims, is an exploration-staged, high-grade, copper-silver-gold project in Idaho, a state that consistently ranks as a top mining jurisdiction by the Fraser Institute,

- Following a reinterpretation of both historical and more recent data, including field work conducted by Dahrouge Geological Consulting USA Ltd. (“DGC”), a new geological model has been proposed and warrants further investigation,

- A past exploration field program conducted by DGC resulted in rock samples that ranged up to 5.61% Cu, 175 g/t Ag, 17.6 g/t Au; the samples returned an arithmetic average of 2.18% Cu, 63 g/t Ag, 3.65 g/t Au,

- Spring/Summer exploration plans designed to refine our exploration targets and further evaluate the economic potential of the identified mineral zones,

- Updated project specific presentation filed on the Monument Peak landing page of the Company’s website.

Mitchell Smith, CEO and Director commented:

“This is a very compelling project in Idaho, an extremely sought after jurisdiction for mining in general but also for copper, silver and gold, all of which are dominant in the mineralization identified at site. With this exploration plan in hand we, in collaboration with Dahrouge Geological are now assessing various options, including potential strategic partnerships, to conduct the work necessary to unlock Monument Peak’s full potential.”

Monument Peak, consisting of 84 claims covering approximately 1,708 acres (~691 hectares), is an exploration-staged, high-grade, copper-silver-gold project, which includes two small past-producing copper mines: Jackson and Hungry Hill. Sporadic exploration, development and production occurred in the region, primarily during the early 1900’s, with some additional development in the 1950’s. The most recent exploration occurred during the 1970’s and 1980’s.

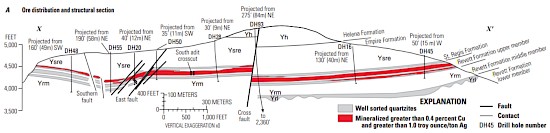

The Cu-Ag +/- Au mineralization at Monument Peak was described (Mitchel, 1972) as having “unusual continuity” in association with structural zones hosted by sericitic quartzites, which can be traced along a 3,200 m strike length. Mineralized width generally ranges from 3 to 6 m but can reach up to 50 m, as described by Lavery (1988). Metamorphosed host quartzites are Proterozoic (1.47 - 1.37 Ma) of the Gunsight Formation and are underlain by the Yellow Lake Formation.

Reinterpretation of Monument Peak

Following a reinterpretation of both historical and more recent data, including field work conducted by Dahrouge Geological Consulting USA Ltd. (“DGC”), a new geological model has been proposed and warrants further investigation. Of particular interest is that similar styled copper-silver mineralization is observed within northern Montana, near the Montana – Idaho border, termed the western Montana Copper Belt. This belt is host to several large sediment-hosted stratabound copper-silver deposits within quartzites of the Proterozoic (1.47 – 1.40 Ma) Revett Formation. Three significant deposits have been documented - Rock Creek, Montanore and Spar Lake:

- Rock Creek contains an inferred resource [2] of100 Mt of 0.7% Cu and 1.5 oz/ton Ag

- Montanore contains an inferred resource [2] of 112 Mt of 0.7% Cu and 1.6 oz/ton Ag

- Spar Lake contains [1] 81 Mt of 0.63% Cu (Figure 1)

Figure 1 - Mineral zonation along the curving long axis of the Spar Lake sandstone copper deposit, Montana, United States, from Hayes et al., 2010.

Note: The resource estimates and comparisons provided herein, including those related to the Rock Creek, Montanore, and Spar Lake deposits, are based on historical exploration data and third-party reports. These are presented for informational purposes only and should not be interpreted as guarantees of similar outcomes for Monument Peak. Investors should be aware that mineral exploration is a high-risk venture, and there is no assurance that these early-stage findings will lead to the discovery of an economically viable deposit. The Company has not independently verified historical data and comparisons and, as such, should not be relied upon as a predictor of future performance.

Hayes et al. (2010) describes sediment-hosted stratabound copper deposits as characterized by their copper mineralization, exhibiting extensive lateral zonation from chalcopyrite through to chalcocite and bornite within sedimentary or metasedimentary hosts. These deposits are categorized into three types based on host lithology and reduced mineralization environment responsible for precipitating copper sulfides from oxidized sedimentary brines:

- Reduced-facies type in organic-rich shale and mudstone

- Sandstone-type in petroleum-associated sandstone/quartzite

- Red-bed type in fluvial sandstone with carbonized plant matter

The Revett, or sandstone subtype, is associated with nearshore marine and beach sandstones and fluvial and aeolian environments. These deposits are typically situated within the topset beds of deltaic sedimentary packages, characterized by their geological setting that facilitate the stratiform distribution of copper minerals. The Revett subtype is characterized by diffuse reductant distribution in the sedimentary matrix, which is crucial for the mineralization process.

The dimensions and mineral content of sediment-hosted stratabound copper deposits vary by type, with reduced-facies and sandstone deposits achieving notable copper grades and tonnage in contrast to red-bed types. Morphologically, these deposits range from sheet-like to lens-shaped bodies, covering vast lateral extents of mineralization (Figure 1). These deposits also stand out as vital sources of gold and silver, with their distinct mineral zonation setting them apart from other sedimentary copper deposits.

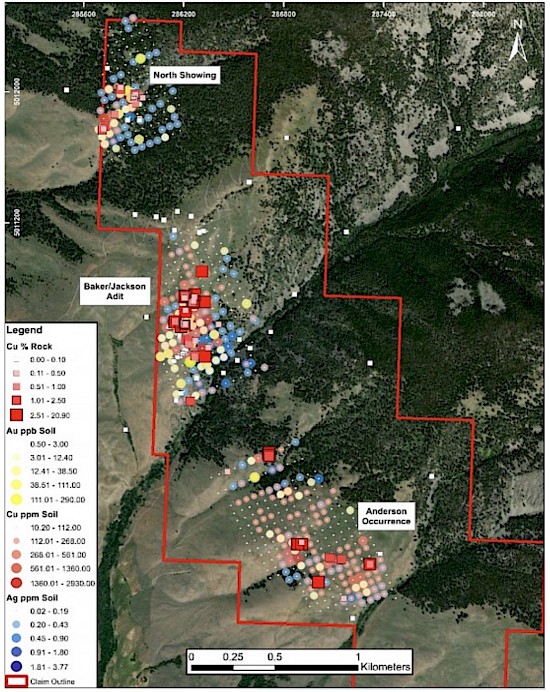

A previous exploration program at Monument Peak undertaken by DGC in 2021, included the collection of 557 soil and 13 rock samples to assess mineralized strike potential.

Project highlights follow (from North to South):

Highlights of Soil Sampling and Geological Reconnaissance (Figure 2):

- Rock samples ranged up to 5.61% Cu, 175 g/t Ag, 17.6 g/t Au; the samples returned an arithmetic average of 2.18% Cu, 63 g/t Ag, 3.65 g/t Au,

- Soil samples show strong geochemical (Cu, Ag, Au) anomalies along the known mineralized trend, which extends for 3,200+ metres,

- A mineralized pit in the south part of the property was identified 200 metres due east of previous known mineralization,

- A newly identified historical trench between the south and central showings confirms continuity of mineralization, and

- Workings, outcrops, and soil geochemistry imply the mineralized system could be continuous over its entire known strike length of 3,200+ metres.

Figure 2 - Monument Peak location map highlighting rock and soil samples collected during 2021 exploration.

Proposed Summer Exploration Strategy

Given the similarities between the style and age of the copper and silver mineralization within the Western Montana Copper Belt and the Monument Peak area, the Company intends to confirm the grades, thickness and style of mineralization at Monument Peak, in advance of drill testing. The spring/summer exploration will include comprehensive surface mapping and the collection of additional rock samples guided by the insights gained from the previous reconnaissance. This strategic approach is designed to refine exploration targets and further evaluate the economic potential of the identified mineral zones.

For more information on Monument Peak, please refer to a recently updated project presentation filed on the Company’s website: https://globalenergymetals.com/portfolio/monument-peak/

References

[1] Hayes, T.S., Cox, D.P., Piatak, N.M., & Seal, R.R. II. (2010). Sediment-Hosted Stratabound Copper Deposit Model. In Mineral Deposit Models for Resource Assessment (Scientific Investigations Report 2010–5070–M, Chapter M). U.S. Department of the Interior, U.S. Geological Survey.

[2] Hecla Mining Company. (2023). Reserves and Resources – 12/31/2023.

[3] Lavery, N.G. (1988). Bolton Lode Gold Prospect, Lemhi County, Idaho. Minerals Exploration & Development.

4] Mitchel, M.J. (1972). Preliminary Geologic Report on the Geerston Creek Copper Claims in Salmon, Idaho. Western Exploration.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. He is a shareholder and Director of the Company.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believes Now is the Time to be part of this electrification movement.

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.