Vancouver, BC / TheNewswire / April 27, 2021 / Global Energy Metals Corporation TSXV:GEMC | OTC:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”), a company involved in the investment exposure to the battery metals supply chain, is pleased to announce results of the 2020 surface sampling program at the Monument Peak copper-silver-gold Project (“Monument Peak”), located in Lemhi County, Idaho, United States.

The Monument Peak Project consists of 69 claims covering approximately 1,380 acres (approximately 558.5 hectares). It is an exploration-stage, high-grade, copper-silver-gold project, which covers two past-producing copper mines: Jackson and Hungry Hill. Past work on the project from the early 1900s through the 1980s identified significant copper, silver mineralization along a 3,200 m trend that is generally from 3 to 6 m thick, but locally reported to be as much as 53 m across.

The fall 2020 program, undertaken by DG Resource Management Ltd., included the collection of 56 rock samples to confirm historic results. The field work confirmed both the presence of significant Cu, Ag mineralization, but also the presence of gold mineralization.

Highlights are as follows:

- A total of 56 rock samples from three main areas over 3,200 m strike and from the separate Hungry Hill Mine, and

- Arithmetic average of all grab samples 2.34% Cu, 57.6 g/t Ag, 0.68 g/t Au.

Field crews visited four known mineral occurrences (Jackson/Baker, Hungry Hill Mine, Anderson and North Showing) and confirmed the high-grade Cu-Ag (+/- Au) mineralization at all locations. Outcrop is sparse throughout the property and commonly only exposed by historic workings. Observed mineralization style and grade is similar across all showings, with notably higher copper grades (up to 20.9% Cu) at Hungry Hill, while the North Showing had the highest gold values (up to 11.4 g/t Au). High grades of silver (greater than 80 g/t Ag) were associated with all mineral occurrences.

Sample results are summarized in Table 1 and highlighted below:

- North Showing: caved adit with abundant copper oxide staining around adit portal;

- Baker/Jackson: several large trenches (to 50 m length); open adit of unknown length within folded schists and quartzites, abundant copper oxide staining, hematite and quartz veins;

- Anderson Showing: numerous trenches and pits; and

- Hungry Hill Mine: Two adits with road to base, historical mine cart system. Abundant bornite/quartz veins occur within sheared chloritic schists at adit portal.

Mineralization is primarily hosted by quartzites, phyllites and schists of the Precambrian Belt Series and is associated with copper oxide stain, hematite and quartz veins.

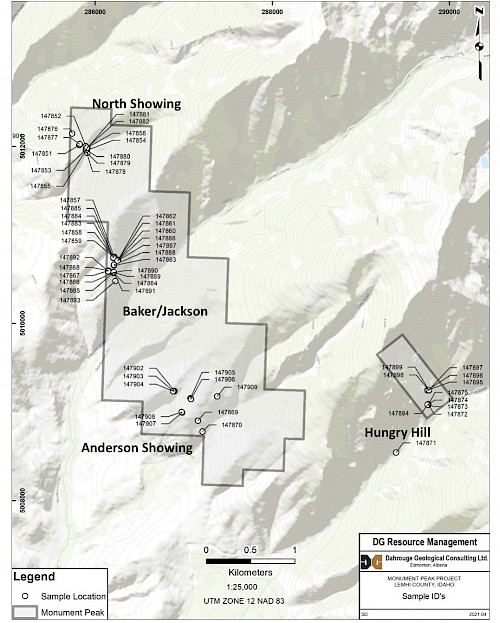

Figure 1 – 2020 Rock Sample ID’s

Table 1 – Notable Results for the 2020 Rock Samples

|

ID |

Easting |

Northing |

Zone |

Cu (%) |

Ag (ppm) |

Au (ppm) |

Sample Source |

Sample Type |

Showing |

|

147851 |

285820 |

5012013 |

12 |

1.81 |

20.1 |

2.300 |

Boulder |

Grab |

North |

|

147853 |

285901 |

5011969 |

12 |

0.41 |

3.8 |

0.206 |

Outcrop |

Grab |

North |

|

147855 |

285911 |

5011983 |

12 |

0.43 |

9.0 |

0.460 |

Boulder |

Grab |

North |

|

147856 |

285908 |

5011986 |

12 |

1.19 |

79.5 |

11.40 |

Boulder |

Grab |

North |

|

147857 |

286217 |

5010754 |

12 |

3.80 |

27.5 |

0.388 |

Boulder |

Grab |

Baker/Jackson |

|

147858 |

286206 |

5010753 |

12 |

7.09 |

84.8 |

0.330 |

Boulder |

Grab |

Baker/Jackson |

|

147859 |

286206 |

5010755 |

12 |

2.36 |

3.8 |

0.144 |

Boulder |

Grab |

Baker/Jackson |

|

147860 |

286260 |

5010719 |

12 |

0.45 |

11.1 |

0.043 |

Boulder |

Grab |

Baker/Jackson |

|

147861 |

286260 |

5010720 |

12 |

6.92 |

106.0 |

0.599 |

Boulder |

Grab |

Baker/Jackson |

|

147862 |

286259 |

5010719 |

12 |

7.19 |

108.0 |

0.452 |

Boulder |

Chip |

Baker/Jackson |

|

147863 |

286211 |

5010655 |

12 |

3.86 |

23.6 |

0.137 |

Boulder |

Grab |

Baker/Jackson |

|

147864 |

286201 |

5010579 |

12 |

2.43 |

19.7 |

0.220 |

Outcrop |

Grab |

Baker/Jackson |

|

147865 |

286205 |

5010572 |

12 |

10.80 |

163.0 |

1.510 |

Boulder |

Grab |

Baker/Jackson |

|

147866 |

286204 |

5010575 |

12 |

1.26 |

18.0 |

0.059 |

Boulder |

Grab |

Baker/Jackson |

|

147867 |

286149 |

5010597 |

12 |

0.70 |

324.0 |

0.920 |

Boulder |

Grab |

Baker/Jackson |

|

147868 |

286150 |

5010598 |

12 |

2.98 |

4.7 |

1.650 |

Boulder |

Grab |

Baker/Jackson |

|

147871 |

289399 |

5008544 |

12 |

0.28 |

17.7 |

0.130 |

Boulder |

Grab |

Hungry Hill |

|

147879 |

285912 |

5011927 |

12 |

0.58 |

12.1 |

0.258 |

Boulder |

Grab |

North |

|

147882 |

285908 |

5011987 |

12 |

1.10 |

16.7 |

1.460 |

Outcrop |

Grab |

North |

|

147884 |

286208 |

5010745 |

12 |

7.24 |

71.1 |

2.190 |

Boulder |

Grab |

Baker/Jackson |

|

147885 |

286206 |

5010745 |

12 |

0.51 |

3.4 |

0.025 |

Boulder |

Grab |

Baker/Jackson |

|

147886 |

286253 |

5010710 |

12 |

5.94 |

187.0 |

2.020 |

Boulder |

Grab |

Baker/Jackson |

|

147887 |

286253 |

5010710 |

12 |

0.70 |

9.7 |

0.050 |

Outcrop |

Grab |

Baker/Jackson |

|

147889 |

286210 |

5010578 |

12 |

0.46 |

7.1 |

0.039 |

Outcrop |

Grab |

Baker/Jackson |

|

147890 |

286210 |

5010577 |

12 |

1.10 |

28.0 |

0.921 |

Outcrop |

Grab |

Baker/Jackson |

|

147891 |

286211 |

5010582 |

12 |

0.49 |

2.5 |

0.023 |

Boulder |

Grab |

Baker/Jackson |

|

147892 |

286146 |

5010592 |

12 |

6.16 |

133.0 |

0.487 |

Boulder |

Grab |

Baker/Jackson |

|

147893 |

286229 |

5010480 |

12 |

1.17 |

883.0 |

2.280 |

Boulder |

Composite |

Baker/Jackson |

|

147894 |

289753 |

5009086 |

12 |

0.59 |

2.7 |

0.093 |

Outcrop |

Grab |

Hungry Hill |

|

147895 |

289751 |

5009248 |

12 |

1.80 |

36.0 |

0.260 |

Boulder |

Grab |

Hungry Hill |

|

147896 |

289750 |

5009247 |

12 |

2.37 |

2.9 |

0.011 |

Boulder |

Grab |

Hungry Hill |

|

147897 |

289767 |

5009247 |

12 |

20.90 |

305.0 |

0.873 |

Outcrop |

Grab |

Hungry Hill |

|

147898 |

289768 |

5009246 |

12 |

3.23 |

90.0 |

0.266 |

Outcrop |

Grab |

Hungry Hill |

|

147899 |

289768 |

5009250 |

12 |

16.50 |

307.0 |

0.006 |

Outcrop |

Grab |

Hungry Hill |

|

147903 |

286887 |

5009235 |

12 |

2.96 |

18.5 |

1.900 |

Boulder |

Grab |

Anderson |

|

147904 |

286882 |

5009236 |

12 |

2.51 |

131.0 |

2.600 |

Boulder |

Grab |

Anderson |

|

147905 |

287075 |

5009156 |

12 |

1.84 |

46.4 |

2.100 |

Outcrop |

Grab |

Anderson |

|

147906 |

287082 |

5009145 |

12 |

1.61 |

1.7 |

0.171 |

Boulder |

Grab |

Anderson |

Mitchell Smith, President & CEO, comments:

"The ongoing consolidation of strategically located battery metals projects has allowed Global Energy Metals to establish itself as a dominant holder of highly prospective critical metals projects with strong exploration and development upside.

Early exploration of Monument Peak has shown not only exceptionally high grades of copper, which will be needed for the US’s domestic supply to continue the electrification of their transportation system, but also significant concentrations of gold and silver."

The company is currently planning for additional spring/summer reconnaissance exploration at Monument Peak, which will include the completion of a NI 43-101 compliant technical report, and which is intended to provide recommendations for an aggressive summer/fall drill program.

Quality assurance/quality control

All rock samples collected (grab) as well as quartz blanks and certified reference materials were shipped by ground to Activation Laboratories Ltd. in Kamloops, B.C., for multi-element analysis (including silver) by aqua regia digestion with ICP-OES finish (code 1E3) and gold analysis by fire assay with AA finish (package 1A2B-50). Over-limit results for gold, silver, copper, lead and zinc were determined by the relevant analytical package.

Management cautions that prospecting surface rock sample assays, as presented herein, are selective by nature and represent a point location and therefore may not necessarily be fully representative of the mineralized horizon sampled.

Figure 2 North Zone - 1.19% Cu, 79.5 g/t Ag, 11.4 g/t Au

Figure 3 Baker Zone - 0.70% Cu, 324 g/t Ag, 0.92 g/t Au

Figure 4 Baker Zone - 1.17% Cu, 883 g/t Ag, 2.28 g/t Au

Figure 5 Hungry Hill - 20.90% Cu, 305 g/t Ag, 0.87 g/t Au

Qualified Persons

Jody Dahrouge, BSc, P. Geo., President of DG Resource Management and a qualified person as defined by NI 43-101, supervised the preparation of the technical information in this news release.

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Global Energy Metals Corporation

(TSXV:GEMC | OTC:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with our current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, we’re investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. We’re targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. We’re also collaborating with industry peers to strengthen our exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. We believe the the time to be part of this electrification movement.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.