Vancouver, BC / TheNewswire / March 23, 2021 / Global Energy Metals Corporation TSXV:GEMC | OTC:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”) is pleased to announce that the Company will submit a permit amendment application to the Bureau of Land Management, Nevada State Office for the first-ever drill program to be conducted on the Lovelock Mine Project in the Cottonwood Canyon area of the Stillwater Range in Nevada. The Lovelock Mine Project is comprised of 81 unpatented lode claims totaling approximately 642 hectares (1586 acres) including the past producing high-grade cobalt-nickel Lovelock Mine.

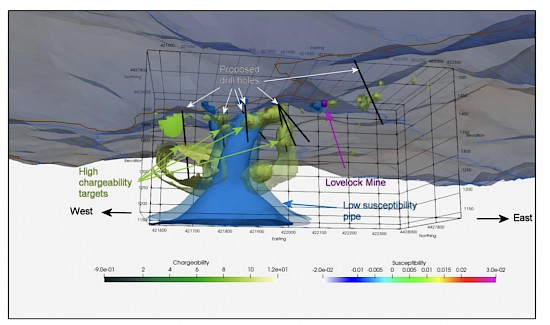

Figure 1 – Lovelock Mine Project Phase 1 Drill Program map outlining the proposed 8 drill holes with corresponding high chargeability targets.

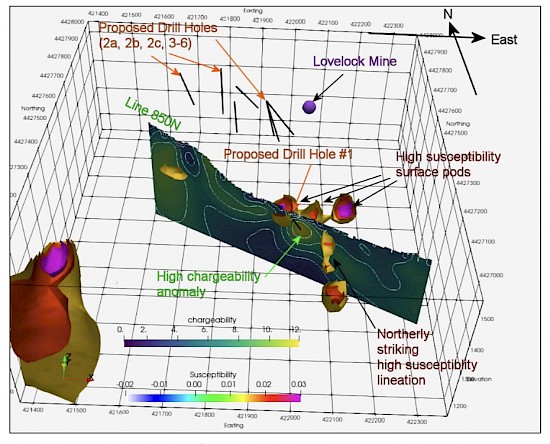

The first pass drilling program at the Lovelock Mine Project is intended to confirm intersections of cobalt-nickel-copper bearing vein that correlates with historical underground mining and mapped superficial cobalt-nickel-copper occurrences. It is anticipated the drill program will demonstrate broader mineralization across the width and depth of the occurrence which remains open in all directions.

Highlights:

- Application will amend an existing approved permit in place for drilling the Lovelock Mine Property;

- First pass drilling program aims to confirm intersections of cobalt-nickel-copper-bearing structures within historical workings;

- The Company’s exploration team is in discussions with a number of drilling operators to begin the approximate 1,400 metre short-hole drill program;

- Drill activities are anticipated to commence in May 2021, subject to weather conditions.

Figure 2 – Lovelock Mine Project Phase 1 Drill Program map outlining the proposed 8 drill holes with corresponding high susceptibility surface pods and chargeability targets.

Timothy Strong, Project Development Manager comments:

“This is a dynamic and exciting time for the company. The announcement of the Company expanding its portfolio into Idaho and Quebec comes at a time when there is highlighted need for critical metals in North America. Whilst we look forward to working with our partners on these new projects, we are delighted to be actively progressing the Lovelock Mine Project in Nevada, and are excited to be initiating this maiden drill program on the property which we hope will provide us with important structural data and confirmation of the high grade mineralisation historically recorded on the property.”

As previously reported in late 2020, an independent interpretation of the regional structure of the Lovelock property, specifically in the vicinity of the historical mining of high-grade cobalt and nickel that occurred at the Lovelock Mine suggest that the Lovelock Mine is located within a corridor of strong structural control with several subparallel structures indicating the potential for multiple mineralized zones related to these structures. Importantly, the geophysics study has identified high-priority drill targets that complement the exploration fieldwork previously conducted.

The data interpretation has allowed for a better understanding of the area, extending from previously mined orebodies to key undeveloped prospects and exploration targets, and greatly enhances the Company’s ability to successfully target and explore for new, buried, high-grade cobalt-nickel-copper deposits across the large footprint in a highly prospective mining district.

The Company is in active discussions with several drill operators with the intent to engage and commence a phase one drill program in the spring, weather permitting.

Definitive Agreement - Idaho and Quebec-based Battery Metals Portfolio

The Company is pleased to announce that it has entered into a definitive agreement with DG Resource Management for the previously announced acquisition (the “Acquisition”) of a fifty percent (50%) interest in a portfolio of battery metal projects, which include:

- Monument Peak, Idaho (Copper, Silver, Gold)

- Chance Lake, Quebec (Nickel, Copper, Cobalt)

- Amiral, Quebec (Nickel, Copper, PGE’s)

The Acquisition is part of an ongoing effort by the Company to assemble battery metals-rich projects in top-tier mining jurisdictions with exploration & development upside.

For additional information on the battery metal project portfolio and terms of the Acquistion, please refer to the Company’s news release dated March 2, 2021.

Private Placement:

In conjunction with the Acquistion the Company has announced a private placement offering for a minimum 2,000,000 units (the “Units”) of the Company at a price of $0.25 per Unit (the “Offering”), with each Unit comprised of one share and one transferrable share purchase warrant (a “Warrant”). Each transferrable warrant will be exercisable to purchase an additional share of the Company for a period of 24 months from the closing date at a price of CAD$0.30.

The net proceeds of the Offering will be used to fund the Acquisition as well as for business development and working capital purposes.

The Company has agreed to and may pay a finder’s fee of 8% cash and 8% broker warrants for Units sold to certain investors (“Broker Warrants”). Each Broker Warrant entitles the holder to acquire one common share of the Company at a strike price of $0.30 for a period of one year from the date of issuance. Warrants are subject to an acceleration clause whereby if on any 10 consecutive trading days occurring after four months and one day has elapsed from the closing date, the daily volume weighted average trading price of the common shares of the Company is at least $0.50 per share, the Company may accelerate the expiry date of the warrants to the 30th day after the date on which the Company gives notice to the subscriber in accordance with the warrant of such acceleration.

All securities to be issued pursuant to the Offering will be subject to a four month hold period from the closing date under applicable securities laws in Canada and among other things, receipt by Global Energy Metals of all necessary regulatory approvals, including the TSX Venture Exchange.

The securities issued in connection with the Offering have not been nor will they be registered under the United States Securities Act of 1933, as amended, or state securities laws, and may not be offered or sold in the United States or to an account for the benefit of US persons, absent such registration or an exemption from registration. This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities in the United States or in any jurisdiction in which such offer, sale, or solicitation would be unlawful.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Global Energy Metals Corporation

(TSXV:GEMC | OTC:GBLEF | FSE:5GE1)

Global Energy Metals is focused on offering investment exposure to the raw materials deemed critical for the growing rechargeable battery market, by building a diversified global portfolio of battery mineral assets including project stakes and sector specific equity positions. GEMC anticipates growing its business through the acquisition and development of battery mineral projects alongside key strategic partners. The Company holds 100% of the Millennium Cobalt Project and two neighbouring discovery stage exploration-stage cobalt assets in Mount Isa, Australia positioning it as a leading cobalt-copper explorer and developer in the famed mining district in Queensland, Australia. The Company, through its 100% owned subsidiary U.S. Battery Metals Corporation, holds an 85% interest in two battery mineral projects, the Lovelock Cobalt Mine and Treasure Box Project, located on the doorstep of the world’s largest lithium-ion battery production plant, the GigaNevada battery mega factory that Tesla Motors Ltd. and partner Panasonic Corp. have built in Nevada, USA. Additionally, the Company holds a 70% interest in the past-producing Werner Lake Cobalt Mine project in Ontario, Canada.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.