Vancouver, BC / TheNewswire / September 27, 2018 / Global Energy Metals Corporation TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”) is pleased to announce the following update regarding the continued exploration drilling program at its Werner Lake Cobalt project (“Werner Lake” and/or the “Project”) located in Ontario, Canada. The Werner Lake exploration program is part of a $2.5 million commitment to advance the project and is being sole funded by Marquee Resources for an earn-in of up to 70% interest in the Project. Global Energy Metals currently owns 100% of the Werner Lake Project.

Highlights:

- Following the successful extension of high grade cobalt sulphide mineralisation in Phase 1 of drilling (WL 18-08, 18-09 and 18-10 awaiting assay results), Phase 2 drill program commenced with 4 additonal holes now completed (WL 18-11, 18-12, 18-13 and 18-14).

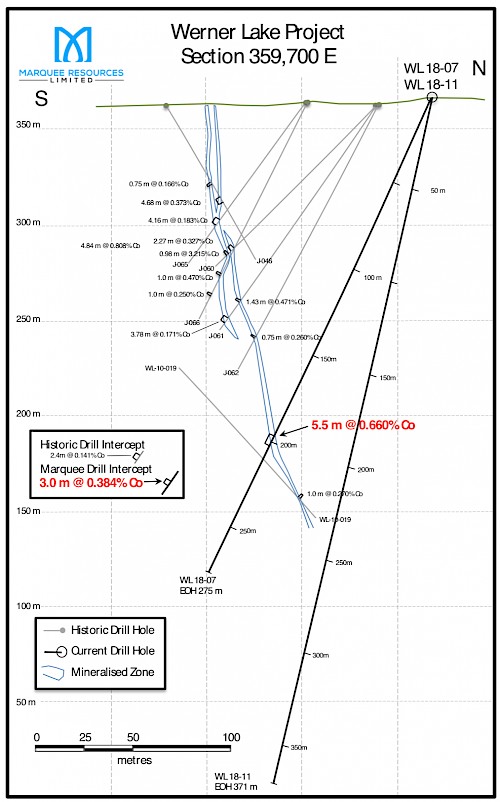

- Hole WL 18-11 targeted the down-dip extension of the West Cobalt Zone, being an undercut of WL 18-07 which was successful in extending the mineralised zone (Figure 1).

- Assay results from the last 7 holes drilled are expected over the coming weeks.

- Results from the phase one drill program have further demonstrated the potential to extend mineralized zones.

- Drilling data from the ongoing exploration program will target mineralisation at depth having the potential to significantly increase the existing NI 43-101 Resource at Werner Lake in an updated resource report.

Following the recent success of drill hole WL 18-07 during Phase 1, which highlighted an encouraging ~50 metres down dip extension of previous mineralisation, the geological team decided that WL 18-11 (Figure 1) was to be the first hole to be drilled in the Phase 2 campaign in order to test the potential for further mineralisation below WL 18-07.

WL 18-07 intersected strong cobalt mineralisation of 0.660% cobalt over 5.5 metres (from 198.5 metres), including a significant 0.7 m interval (from 198.5 metres) that assayed 3.150% cobalt, though two significant intervals below this interval assayed over 0.3% cobalt, representing a strong zone of mineralisation.

The drilling of holes WL 18-08, 18-09 and 18-10 saw the completion of the Phase 1 drill campaign. Total metres drilled for Phase 1 were 2,122m. Assays are pending and are expected to be received and released shortly. The Phase 2 campaign has completed 4 holes to date and core samples have been sent to the lab for analysis. The total metres completed so far for Phase 2 is 1,520 metres.

The Company will continue to release assay results as soon as practical after having been received, reviewed and analysed.

Figure 1: Simplifed Cross Section 359,700

Private Placement:

On September 20th, the Company announced a $500,000 Private Placement with net proceeds being used for the completion of the recently announced cobalt project acquistions, for marketing initiatives as well as general working capital requirements.

The Private Placement will consist of the issuance of a maximum of 6,666,667 units (the “Units”) at a subscription price of CAD$0.075 per Unit. Each Unit will be comprised of one common share of the Company (a “Share”) and one transferable common share purchase warrant (a “Warrant”). Each Warrant will be exercisable to purchase an additional Share of the Company for a period of 12 months from the closing date (“Closing Date”) at a price of CAD$0.15 subject to acceleration.

All securities issued in connection with the Private Placement will be subject to a statutory hold period of 4 months plus a day from the Closing Date in accordance with applicable securities legislation. Warrants are subject to an acceleration clause whereby if on any 10 consecutive Trading Days occurring after four months and one day has elapsed from the Closing Date, the daily volume weighted average trading price of the common shares of the Company is at least $0.20 per share, the Company may accelerate the expiry date of the Warrants to the 30th day after the date on which the Company gives notice to the Subscriber in accordance with the Warrant of such acceleration. Finder's fees may be paid in connection with this Offering. Closing of the Private Placement is subject to the approval of the TSXV.

Qualified Person

Mr. Paul Sarjeant, P. Geo., the Company’s VP Projects and Director, is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects and has reviewed and verified the technical information contained herein.

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals is focused on offering security of supply of cobalt, a critical material to the growing rechargeable battery market, by building a diversified global portfolio of cobalt assets including project stakes, projects and other supply sources. GEMC anticipates growing its business by acquiring project stakes in battery metals related projects with key strategic partners. Global Energy Metals currently owns and is advancing the Werner Lake Cobalt Mine in Ontario, Canada and has entered into an agreement to earn-in to the Millennium Cobalt Project in Mt. Isa, Australia.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219 extensions 236/237

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management‘s beliefs, estimates or opinions, or other factors, should change. For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.