Millennium & Mount Isa Projects

-

Location

Mount Isa, Queensland, Australia

Historic Estimate* JORC (2012) Inferred Resource on the property of 3.1 million tonnes @ 0.14% Co, 0.34% Cu and 0.12g/t Au (using CuEq cutoff of 1.0%) Highlights The Millennium Project is a significant cobalt-copper deposit that remains open for expansion.

The Project is located close to well established mining, transport and processing infrastructure along with a skilled workforce in the regional centres of Mount Isa and Cloncurry.

Excellent potential and further upside in extending the known mineralized structure through exploration work to the north and to the east. Preliminary hydrometallurgical studies have demonstrated the potential for the recovery of saleable cobalt and copper concentrates.

Project Status Exploration Stage Ownership GEMC holds 49% of the Millennium property with Metal Bank holding 51% as of December 5, 2022. *This work was based on a technical report by Haren Consulting Pty Ltd., issued November 29, 2016 conforming to JORC (2012) reporting standards for resources estimates. As Hammer uses JORC categories, it should be noted that the confidence in the estimate of JORC inferred mineral resources is usually not sufficient to allow the results of the application of technical and economic parameters to be used for detailed planning. For this reason, there is no direct link from an inferred resource to inferred resource as defined under NI 43-101. However, the Company deems this resource still relevant because economic parameters have not changed significantly since publication date and the Company has confidence in the estimate based on review of technical data. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves and the issuer is not treating the historical estimate as current mineral resources or reserves. CuEq%= Cu% +(Co%*5.9) +(Au ppm*0.9) +(Ag ppm*0.01). Price assumptions utilised by Hammer for the JORC resource estimate and drill hole intercepts are (in USD); Au - $1,300/oz, Ag - $20/oz, Co - $27,000/t and Cu - $4,600/t.

The Millennium Technical Report is a restate of the inferred JORC Mineral Resource estimate for the Millennium Project originally published by Haren Consulting for Hammer Metals Limited (“Hammer”) and does not include data from the 1,140 meter 2018 drill program that confirmed continuity between the previously reported high-grade cobalt zones indicating wide zones of cobalt mineralisation near surface and at depth with assay results indicating metal grades exceeding prior expectations.

Click on the image below to read the full report by Kangari Consulting Limited.

Future Progress

The Project presents as an excellent opportunity to develop a cobalt asset of significant size with potential to expand mineralisation in close proximity to a processing solution and excellent infrastructure within the Mount Isa region of Queensland, Australia. It is anticipated that GEMC will conduct further infill drilling to tighten drill spacing and test for potential extensions at depth and along strike, which the Company believes, could result in a material increase in the size of the current JORC resource. Additional drilling will allow for greater modelling continuity and increased confidence level of the current reported “inferred resource” category to Indicated and/or Measured categories under NI 43-101 reporting standards.

At current and future predicted cobalt prices, cobalt is the dominant economic metal within the deposit and GEMC will remodel the deposit on a cobalt-equivalent basis.

Partnership

On June 7, 2021, GEMC entered into a binding agreement with Metal Bank Limited (“Metal Bank” and/or “MBK”) for a 6 month exclusive option (“Option”) in favour of MBK to earn-in and joint venture the Millennium Copper, Cobalt and Gold Project in Mount Isa, Queensland (“Millennium Project”) owned by GEMC’s wholly owned subsidiary, Element Minerals Australia Pty Ltd (“EMA”).

During the Phase 1 exclusive 6-month option period, MBK undertook further due diligence and completed an initial exploration program to confirm the potential for mineralisation in the northern half of the tenement package.

At the end of the option period, MBK was granted the right to commence a formal earn-in to the Project to earn up to an 80% interest over Phases 2 and 3 below:

- Phase 2 – MBK to earn a 51% interest in the Project by issuing AUD $250,000 of MBK Shares to GEMC and sole funding exploration expenditure of $1M; COMPLETED

- Phase 3 – MBK to earn an additional 29% interest (taking its total interest to 80%) by issuing AUD $350,000 of MBK Shares to GEMC and sole funding expenditure of AUD $2M; and

- Phase 4 – GEMC may elect to require MBK to buy out GEMC’s remaining 20% interest for shares in MBK at a value to be agreed, and failing such election, both parties are to fund expenditures in proportion to their respective interests.

The terms of the Agreement are summarized in detail below.

MBK has been granted a right of exclusivity from the date of the Agreement to 30 June 2021 in consideration of the payment of AUD $10,000 to GEMC. The right of exclusivity will extend through the Option Period following signing of an Option Agreement.

During the initial period, MBK and GEMC will finalise an Option Agreement and detailed earn-in and joint venture terms.

MBK’s exclusive option to earn-in and joint venture the Project will commence upon signing the Option Agreement and payment of a further AUD $10,000 payment to GEMC, and will continue for a term of 6 months (Option Period).

During the Option Period MBK will complete the Phase 1 Work Program described below.

On or before expiry of the Option Period, MBK may give notice to GEMC exercising the exclusive Option to earn-in and joint venture the Project and move to Phase 2.

If MBK does not exercise the option then the agreement is at an end.

At the commencement of Phase 2, MBK issue the equivalent of AUD $250,000 in MBK shares to GEMC and MBK will sole fund exploration expenditure of AUD $1M on the Phase 2 Work Program described below to earn a 51% interest in the project.

Upon completing its Phase 2 expenditure commitment, MBK has as of December 5th, 2022:

- Elected to earn the 51% interest and form the joint venture and move to Phase 3;

At the commencement of Phase 3, MBK issued the equivalent of AUD $350,000 in MBK shares to GEMC and a Joint Venture will be formed with MBK sole funding and managing. During Phase 3, MBK will sole fund exploration expenditure of AUD $2M on the Phase 3 Work Program described below to earn an additional 29% interest in the project, taking MBK’s total interest to 80%.

Upon MBK completing its Phase 3 expenditure commitment and moving to an 80% interest, EMA may elect to require MBK to buy out EMA’s remaining 20% interest for shares in MBK at a value to be agreed.

If EMA does not make this election, both parties will jointly fund exploration, feasibility and development expenditure in their proportionate shares, with each parties’ interest diluted in accordance with a standard industry dilution formula should either MBK or GEMC not contribute.

MBK Option, Earn-in and JV Work Programs

Note: Work programs are indicative and may change subject to exploration results.

Phase 1 – Option Period -- COMPLETED

- detailed geological mapping

- infill pXRF soil survey (25m spacing) and mapping to refine drilling locations

- reconnaissance drilling up to 4 reverse circulation (“RC”) holes (2 section lines) for up to 500m at Millennium North

Phase 2 - Earn-in – Resource and exploration drilling -- COMPLETED

- Millennium Resource

- 2 x deep down dip extension test holes – for 600m (RC/DD)

- 6 x resource infill holes – for 900m (RC/DD)

- Millennium North

- 14 holes on 7 section lines at 100m spacing – 2,800m (RC)

- Federal/Corella Trend

- early reconnaissance exploration - up to 4 x RC holes for up to 600m (RC)

Phase 3 - Joint Venture – Resource upgrade and commencement of feasibility study -- UNDERWAY

- Millennium Resource upgrade (drill-out) – up to 2,500m Diamond drilling

- Update Mineral Resource Estimate

- Commencement of feasibility study

Phase 4 – Joint Venture

- Completion of bankable feasibility study

- Development approvals

- Development

- Mining

Location

The Mount Isa Inlier is a highly mineralised, established mining jurisdiction with significant regional infrastructure and several world-class copper-gold-cobalt and lead-zinc-silver mines and deposits, including CuDeco Limited’s operating Rocklands copper-gold-cobalt project located 19 kilometres to the northwest.

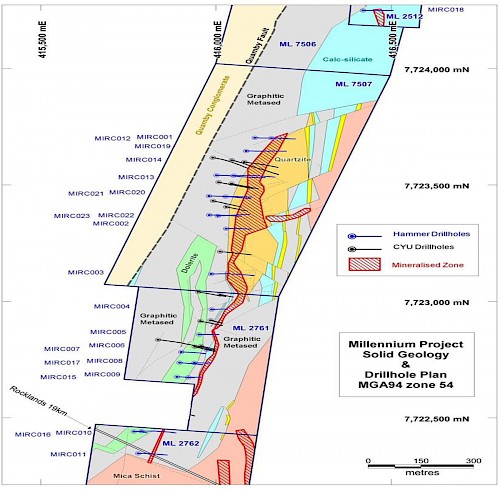

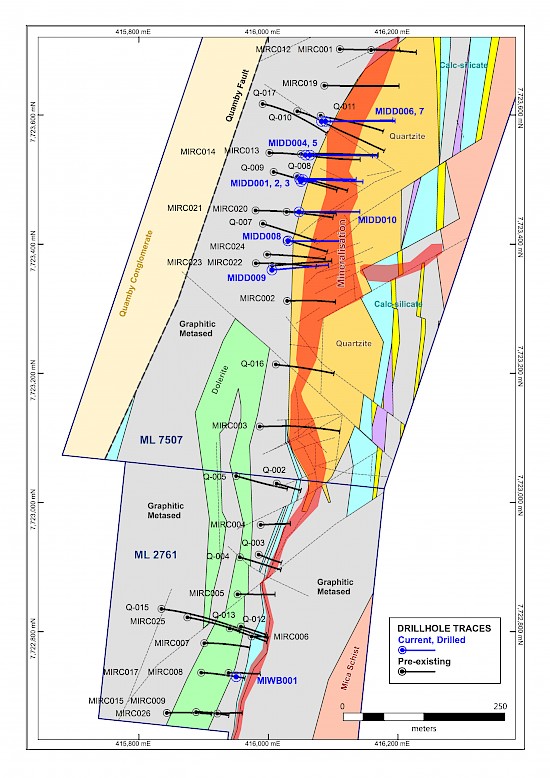

The Project comprises five Mining Leases; ML’s 2512, 2761, 2762, 7506 and 7507. Hammer currently has a 100% interest in all five Mining Leases. The tenements are in good standing with no known impediments.

GEMC Exploration

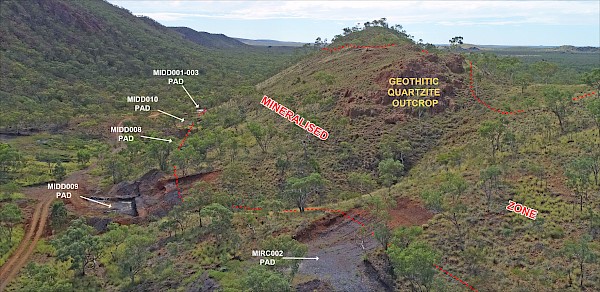

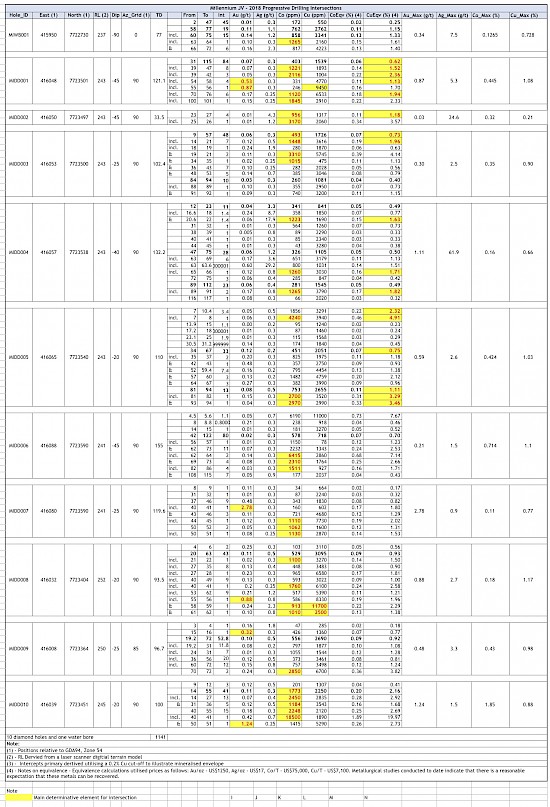

The objective of the 10-hole, 1,141 metre drilling campaign was to test the up-dip continuity at the Millennium North deposit and confirm historical estimates of cobalt mineralization reported in 2016 by operating partner Hammer Metals. Drilling results correlate well with the previous deeper drilling with the further delineation of wide zones of cobalt, copper and gold mineralisation nearer to surface. The drilling campaign is now complete. Analysis and reporting of the previous drill results can be found in news releases dated June 19, 2018, May 31, 2018, April 30, 2018 and January 17, 2018.

Rock chip sampling has also been conducted to test for additional zones of cobalt and copper mineralisation along the Millennium trend and in particular the northern strike extension (“Northern Extension”) where similar host rock units and strong soil geochemical anomalies have been identified.

This zone is located approximately 1 kilometre north of the current Millennium resource as defined. Results indicate high priority targets for further work to expand the known resource area.The presence of anomalous cobalt and copper in rock chip samples and analogous geology between the Millennium resource area and the Northern Extension indicate that this area is a priority target for further investigation.

Phase One 2018 Progressive Drilling Intersections

History

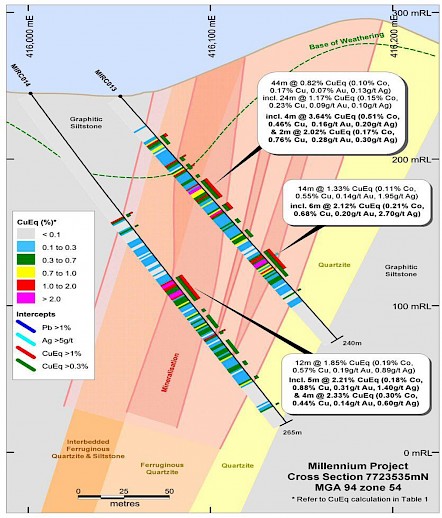

Drilling in 2016 from Hammer’s 23 RC drill hole program (Hammer ASX releases, 13/09/2016 and 14/10/2016 ) included peak cobalt results with 8 metres at 0.35% Co in MIRC023 and 4 metres at 0.51% Co in MIRC013.

Other intercepts included:

- 19 m at 0.38% Co, 1.27% Cu, 0.70 g/t Au, (4.12% CuEq) in Q-012;

- 24 m at 0.15% Co, 0.23% Cu and 0.09 g/t Au (1.17% CuEq) in MIRC013;

- including 4 m at 0.51% Co, 0.46% Cu and 0.16 g/t Au (3.64% CuEq),

- 12 m at 0.19% Co, 0.57% Cu and 0.19 g/t Au (1.85% CuEq) in MIRC014;

- including 4 m at 0.30% Co, 0.44% Cu and 0.14 g/t Au (2.33% CuEq),

- 40 m at 0.07% Co, 0.32% Cu and 0.13 g/t Au (0.82% CuEq) in MIRC017;

- including 5 m at 0.15% Co, 0.82% Cu and 0.21 g/t Au (1.90% CuEq); and

- 33 m at 0.16% Co, 0.66% Cu and 0.34 g/t Au (2.11% CuEq) in MIRC023;

including 8 m at 0.35% Co, 0.08% Cu (2.19% CuEq).

All intercepts reported represent core lengths; true width will vary depending on the intersection angle with the targeted zone. Holes are generally planned to intersect mineralised zones as close to perpendicular as possible. Copper equivalent (CuEq) calculation is as follows: CuEq% = Cu% +(Co%*5.9) +(Au ppm*0.9) +(Ag ppm*0.01). Price assumptions utilised by Hammer for the JORC resource estimate and drill hole intercepts are (all $US); Au - $1,300/oz, Ag - $20/oz, Co - $27,000/t and Cu - $4,600/t.

There are no more recent estimates or data available. To upgrade this work from an historical estimate to a current mineral resource, the Company will review the data set and complete additional drilling and modeling work to verify the historic estimate as a current mineral resource or mineral reserve.

Recent drilling and exploration to date has returned outstanding, high-grade intercepts and there is excellent potential to build upon the historic estimate as developed by Hammer. Based on previous work by Hammer and others, mineralisation is interpreted to extend over a strike length of 1,600 metres and extends to approximately 280 metres below surface. Multiple high-grade targets are awaiting further exploration and the mineralised zone remains open at depth and to the north along strike.

Hammer drilled a total of 23 RC holes and extended two previous holes at Millennium in a late 2016 work program. The results build on previous drilling conducted in the area and 40 drill holes were used in the first JORC (2012) mineral resource estimate for the project.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and verified the technical information contained herein.