Vancouver, BC / TheNewswire / February 2nd, 2021 / Global Energy Metals Corporation TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1 ("Global Energy Metals", the "Company" and/or "GEMC") is pleased to announce that the Company has closed the sale of its 0.5% gross metal royalty (the “Royalty”) announced on July 23, 2020 to Electric Royalties Ltd. (“Electric Royalties” and/or “ELEC”) on the Millennium Cobalt Project, the Mt. Dorothy Cobalt Project and the Cobalt Ridge Project located in Queensland, Australia.

Mitchell Smith, President and CEO, states:

"We are pleased by this first monetization of our Australian-based battery mineral asset portfolio. The initial 1,150,000 shares in Electric Royalties, equating to approximately a 2.5% interest in ELEC, will provide our shareholders with a way to participate in an aggressive and rapidly growing royalty company focused on minerals core to the electric revolution.

Additionally, the cash component from the sale will allow GEMC to accelerate its mandate of diversifying exposure to the battery minerals supply chain and allow for the Company to further capitalize on the shift to electric mobility and new forms of clean energy storage driven by accelerated efforts to reduce the world’s dependence on fossil fuels.”

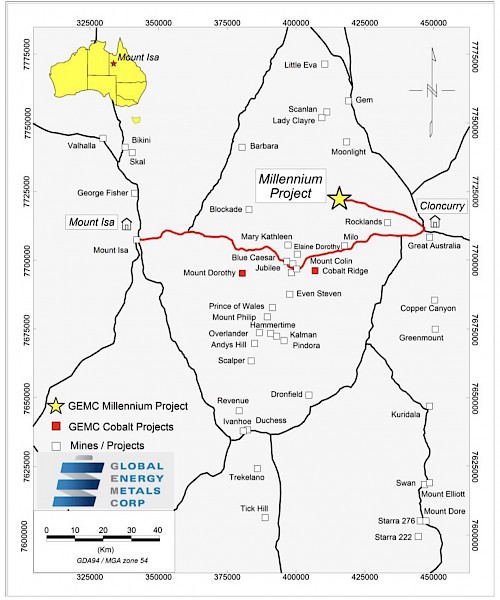

Through its wholly-owned subsidiary, Element Minerals Australia PTY, Global Energy Metals has established extensive tenement holdings totaling 2,560 hectares (6,326 acres) across the Mount Isa and Cloncurry mining districts in northwest Queensland, Australia. This commanding land package contains a number of properties with significant cobalt, copper, gold and base metal exploration potential. These range from undeveloped exploration prospects to JORC-compliant resources. The properties include the Millennium Cobalt Copper Gold deposit, and the Mount Dorothy and Cobalt Ridge exploration prospects.

The Mount Isa Inlier is a significant gold and base metal producing district hosting many world class copper-gold and lead-zinc-silver deposits. The region is also prospective for gold, phosphate, cobalt, rare-earths, molybdenum and rhenium mineralisation and has a number of significant operating mines and new projects in development. There is well established mining, transport and processing infrastructure in close proximity to the regional centres of Mount Isa and Cloncurry and the Millennium property.

Figure 1. Location Map of Millennium and Mount Isa Projects in an Established Mining Region with World-Class Infrastructure

Initial Royalty

As consideration for the Royalty on Millennium and the Mount Isa Projects, Electric Royalties will issue to Global Energy Metals 1.15 million shares (the “Consideration Shares”) in Electric Royalties and make a CAD $150,000 cash payment. The Consideration Shares will be subject to resale restrictions over a period of eighteen months from the date of issuance.

Additional Royalties Option

Electric Royalties has also been granted a call option (“First Option”), exercisable at any time, for a period of two years from the closing date, to acquire a 0.5% royalty on the Net Smelter Returns from the Millennium Cobalt Project (the “Millennium NSR”), by paying C$500,000 to Global, payable up to 25% in shares of ELEC, at ELEC’s election.

Upon exercise of the First Option, ELEC will have a call option, exercisable on the earlier of: (i) the third anniversary of the closing date and (ii) six months from the date that a preliminary economic analysis or similar study on the Millennium Project is provided to ELEC, to increase the Millennium NSR by a further 1%, by paying C$1,000,000 to Global, payable up to 25% in shares of ELEC, at the election of ELEC.

For more information about the Royalty transaction please refer to the terms of the agreement first announced on February 27, 2020 and subsequently on July 23, 2020.

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel & copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to feed the electric revolution.

Electric Royalties has a portfolio of 11 royalties and plans to focus predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk.

Qualified Person

Mr. Paul Sarjeant, P. Geo. and Director, is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects and has reviewed and verified the technical information contained herein.

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals is focused on offering investment exposure to the raw materials deemed critical for the growing rechargeable battery market, by building a diversified global portfolio of battery mineral assets including project stakes and sector specific equity positions. GEMC anticipates growing its business through the acquisition and development of battery mineral projects alongside key strategic partners. The Company holds 100% of the Millennium Cobalt Project and two neighbouring discovery stage exploration-stage cobalt assets in Mount Isa, Australia positioning it as a leading cobalt-copper explorer and developer in the famed mining district in Queensland, Australia. The Company, through its 100% owned subsidiary U.S. Battery Metals Corporation, holds an 85% interest in two battery mineral projects, the Lovelock Cobalt Mine and Treasure Box Project, located on the doorstep of the world’s largest lithium-ion battery production plant, the GigaNevada battery mega factory that Tesla Motors Ltd. and partner Panasonic Corp. have built in Nevada, USA. Additionally, the Company holds a 70% interest in the past-producing Werner Lake Cobalt Mine project in Ontario, Canada.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.