Vancouver, BC / TheNewswire / December 5, 2022 / Global Energy Metals Corporation TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”), a company involved in investment exposure to the battery metals supply chain, is pleased to provide a key update from its Millennium copper-cobalt-gold (Cu-Co-Au) project (“Millennium” and/or the “Project”) located in Queensland, Australia.

GEMC is pleased to announce that Metal Bank Ltd. (“MBK”), through its wholly owned subsidiary MBK Millennium Pty Ltd (MBKM), has provided the Company with a Stage 1 earn-in notice, having completed all of the obligations under the under the Millennium earn-in and joint venture agreement (JV Agreement) with Global Energy Metals and its wholly owned subsidiary, Element Minerals Australia Pty Ltd (EMA), including the investment of in excess of $1 million in exploration spend on the project. The companies will enter Stage 2 under the agreement, which the JV Agreement will govern.

Figure 1: Millennium RC drilling, Northern Area

Highlights

- The Millennium three phase 2022 work program has been completed

- MBK’s Millennium Stage 1 Earn-in expenditure of $1M has been met

- MBK has given notice to elect to form the Millennium Joint Venture with MBK holding a 51% joint venture interest and GEMC holding a 49% interest in the Project

- MBK will now move to Stage 2 of the JV to increase its joint venture interest to 80%

- Resource upgrade work has commenced

Mitchell Smith, CEO & Director of GEMC commented:

“We are delighted to have reached this key stage in the JV agreement and for the vote of confidence in the potential for this strategic project. We welcome Metal Bank’s commitment to further advance Millennium through accelerated exploration activities and realize its opportunity as an asset of significant importance in filling future demand for critical metals, such as cobalt and copper, at a time when our economy transitions to a sustainable low carbon and electrified world.”

Commenting on the results, Metal Bank’s Chair, Inés Scotland said:

“MBK now holds a 51% interest in the Millennium project and its existing JORC resource of 5.9MT @ 1.08% CuEq, which has been confirmed and expanded by our 2022 exploration program. Millennium provides MBK with exposure to copper and cobalt – in demand, critical components for the renewable energy transition. With the project’s granted Mining Leases and proximity to processing solutions, Millennium presents a real opportunity for near-term development.”

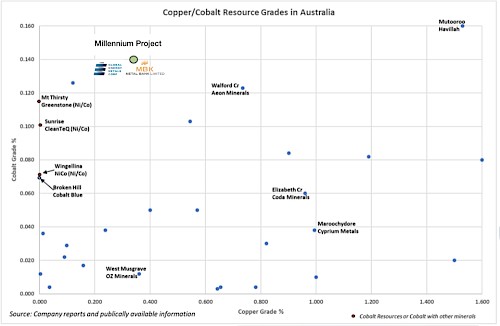

Figure 2: Copper/Cobalt project resource grades, Australia

The JV Agreement was entered into in December 2021. Since that time, as part of its Stage 1 earn-in, MBK has completed a 3 Phase exploration program at the Millennium copper-cobalt-gold (Cu-Co-Au) project in Queensland, which holds an inferred 2012 JORC resource of 5.9MT @ 1.08% CuEq across 5 granted Mining Leases with significant potential for expansion. MBKM has sole funded exploration expenditure of more than $1M satisfying its stage 1 earn-in obligations under the JV Agreement and has given notice to EMA electing to acquire a 51% Joint Venture Interest in the Millennium project and assets.

In accordance with the JV Agreement, MBK will issue 10,416,667 MBK shares to the value of AUD $350,000 to GEMC at a price of $0.0336 (being the average 5 day VWAP at the last business day prior to the date of MBKM’s notice), following the Company’s Annual General Meeting and consolidation of the Company’s share capital (subject to shareholder approval at the AGM).

Following issue of these Shares, MBKM will hold a 51% Joint Venture Interest in the Millennium project and assets and will have the sole and exclusive right to earn an additional 29% Joint Venture Interest (taking its total interest to 80%) by sole funding exploration expenditure to the amount of $2 million.

The Millennium Project represents an excellent opportunity for MBK to advance and develop a copper-cobalt asset of significant size, close to processing solutions and excellent infrastructure in the Mount Isa region. The cobalt grades reiterate Millennium as one of Australia’s highest grade undeveloped battery metals projects, contained within granted mining licenses.

Millennium Project

The Millennium Copper and Cobalt Project near Cloncurry in NW QLD currently holds a JORC 2012- compliant Inferred Resource of 5.9Mt @ 1.08% CuEq (Cu-Co-Au-Ag) across 5 granted Mining Leases with significant potential for expansion. It is located 19km from the Rocklands copper-cobalt project with an established processing plant capable of treating Millennium-style ores once recommissioned.

MBK’s 2021 drill results and other previous drilling, in conjunction with significant appreciation in copper and cobalt prices since maiden Resource reporting, provided support for an initial Exploration Target for the Project of 8 – 10Mt @ 1.0 – 1.1% CuEq.

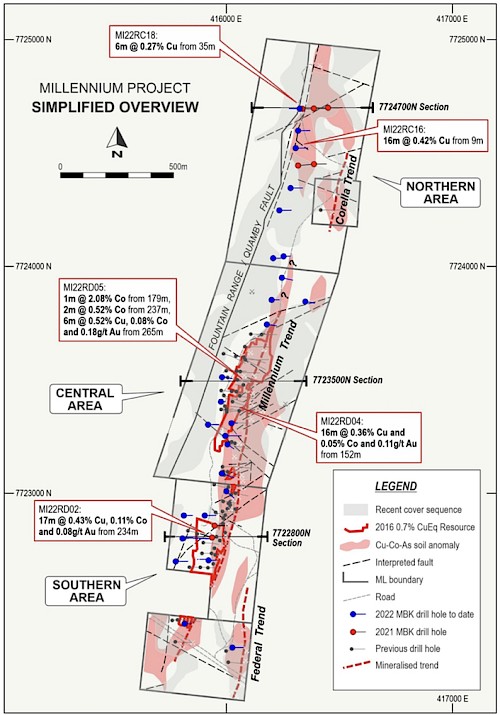

MBK developed a three-phase work program for Millennium in 2022 seeking to confirm the Exploration Target for the Project, and future Resource expansion and development potential. The Exploration Target is based on extensions both along strike and at depth in both the Southern and Central Area copper-cobalt-gold Resources and in the Northern Area, where shallow copper intervals at broad spacing have been returned some 800-1000m north of the closest Resource.

Upon receipt and assessment of all results from the current 2022 drilling program, MBK will embark on a JORC 2012-compliant Resource update and Scoping Study utilising appropriate economic parameters aimed for completion late 2022.

It should be noted that the Exploration Target is conceptual in nature. There has been insufficient drilling at depth of the existing Resource and in the Northern Area of the project and insufficient information relating to the Reasonable Prospects of Eventual Economic Extraction (RPEEE) of the Millennium project to estimate a Mineral Resource over the Exploration Target area, and it is uncertain if further study will result in the estimation of a Mineral Resource over this area. It is acknowledged that the currently available data is insufficient spatially in terms of the density of drill holes, and in quality, in terms of MBK’s final audit procedures for down hole data, data acquisition and processing, for the results of this analysis to be classified as a Mineral Resource in accordance with the JORC Code.

Figure 3: Millennium Project overview showing recent drilling results

About Metal Bank

Metal Bank Limited is an ASX-listed minerals exploration company (ASX: MBK) holding a significant portfolio of advanced gold and copper exploration projects with substantial growth upside, including:

- the right to earn up to 80% of the Millennium Copper & Cobalt project which holds an inferred 2012 JORC resource of 5.9Mt @ 1.08% CuEq, across 5 granted Mining Leases with significant potential for expansion;

- a 75% interest in the advanced Livingstone Gold Project in WA which holds a JORC 2004 Inferred Resource of 49,900oz Au at the Homestead prospect, a JORC 2012 Inferred Resource of 30,500oz Au at Kingsley, and an Exploration Target of 290 – 400Kt at 1.8 – 2.0 g/t Au for 16,800 – 25,700oz Au at Kingsley; and

- the 8 Mile, Wild Irishman and Eidsvold Gold projects in South East Queensland where considerable work by MBK to date has drill-proven both high grade vein-style and bulk tonnage intrusion-related Au mineralisation.

Metal Bank’s exploration programs at these projects are focussed on:

- short term resource growth - advancing existing projects to substantially increase JORC Resources;

- identifying additional mineralisation at each of its projects; and

- assessing development potential and including fast tracking projects through feasibility and development to production.

Metal Bank is also committed to a strategy of diversification and growth through identification of new exploration opportunities which complement its existing portfolio and pursuit of other opportunities to diversify the Company’s assets through acquisition of advanced projects or cash- flow generating assets to assist with funding of the exploration portfolio.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believes Now is the Time to be part of this electrification movement.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.