Vancouver, BC / TheNewswire / June 7, 2021 / Global Energy Metals Corporation TSXV:GEMC | OTC:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”), a company involved in investment exposure to the battery metals supply chain, is pleased to announce that it has entered into a binding Term Sheet with Metal Bank Limited (“Metal Bank” and/or “MBK”) for a 6 month exclusive option (“Option”) in favour of MBK to earn-in and joint venture the Millennium Copper, Cobalt and Gold Project in Mt Isa, Queensland (“Millennium Project”) owned by GEMC’s wholly owned subsidiary, Element Minerals Australia Pty Ltd (“EMA”).

The Millennium Project is an advanced exploration and development project located in the Mount Isa region, 19km from the Rocklands copper-cobalt project which is host to 55.4Mt of Resources grading 0.64%Cu, 0.15 g/t Au, 290ppm Co (0.90% CuEq)1. The Millennium Project holds an inferred 2012 JORC resource of 5.89MT @ 1.08% CuEq2 across 5 granted Mining Leases with significant potential for expansion.

Highlights

- Global Energy Metals and Metal Bank Limited (ASX:MBK) have signed a binding Term Sheet for a 6 month exclusive option for MBK to earn-in and joint venture GEMC’s Millennium copper-cobalt-gold Project in Queensland;

- Millennium contains an inferred Cu equivalent Mineral Resource of 5.89MT2 with substantial growth upside;

- Millennium presents as an excellent opportunity to advance and develop a copper-cobalt asset of significant size in close proximity to processing solutions and excellent infrastructure in the Mount Isa region;

- During the proposed exclusive 6 month option period, MBK will undertake further due diligence and sole-fund an initial exploration program;

- At the end of the Option Period, MBK will have the right to commence a formal earn-in to the Project to earn up to an 80% interest; and

- The transaction advances GEMC’s objectives of monetizing its existing projects by unlocking unrealized value and advancing projects through partner funded exploration; and

- GEMC retains project level exposure while diversifying its equity holdings in a well managed company that is creating value through a combination of exportation success and quality project acquisition.

1CDU:ASX Announcement dated 31 October 2017

2 HMX ASX Announcement dated 6 December 2016 “Millennium Mineral Resource Estimate”. Copper equivalent (CuEq) calculation was based solely on commodity prices using prices as follows: Cu: US$4,600/t; Co: US$27,000/t; Au: US$1,330/oz; and Ag: US$20/oz

Mitchell Smith, President and CEO of Global Energy Metals commented:

"Global Energy welcomes the opportunity to partner with Metal Bank to fund a phased work campaign at our Millennium Cobalt-Copper-Gold project, which presents as an excellent opportunity for successful exploration and development of a highly prospective battery metal project. Additionally , it provides GEMC with continued exposure to the project through both maintained project level ownership and a sizeable equity interest in Metal Bank.

Led by Inés Scotland, Guy Robertson, Sue-Ann Higgins and Rhys Davies, the Metal Bank team has a track record of global success including several discoveries that have proceeded to mine development and project sale generating billions of dollars. This extensive experience, transactional know-how and industry pedigree that will be put to use by the MBK team to aggressively advance the Millennium project is a significant opportunity for Global Energy Metals and its shareholders."

Commenting on the transaction, Inés Scotland, MBK Chair said:

"Our agreement with GEMC provides MBK with an option to earn-in to an advanced copper-cobalt asset of significant size with excellent expansion potential and an accelerated pathway to production.

The market fundamentals for copper and cobalt are extremely favourable and we consider there is significant growth potential across the project area. We are excited to be partnering on this project with GEMC, a company advancing and building a diversified global portfolio of exploration and growth-stage battery mineral assets.

This transaction is an exciting opportunity for MBK and its shareholders in pursuit of our strategy for diversification and growth, providing exposure to copper and cobalt which are in demand, vital components in the production of electric batteries, in addition to our existing portfolio of gold assets in Queensland."

Commencement of the Option is subject to MBK and GEMC finalising and signing a formal Option Agreement prior to 30 June 2021. GEMC have granted MBK a right of exclusivity in relation to the Millennium Project for this purpose, in consideration of MBK’s payment of AUD $10,000.

MBK will make a further AUD $10,000 payment to GEMC upon signing the Option Agreement.

During the proposed Phase 1 exclusive 6-month option period, MBK will undertake further due diligence and complete an initial exploration program to confirm the potential for mineralisation in the northern half of the tenement package.

At the end of the option period, MBK will have the right to commence a formal earn-in to the Project to earn up to an 80% interest over Phases 2 and 3 below:

- Phase 2 – MBK to earn a 51% interest in the Project by issuing AUD $250,000 of MBK Shares to GEMC and sole funding exploration expenditure of $1M;

- Phase 3 – MBK to earn an additional 29% interest (taking its total interest to 80%) by issuing AUD $350,000 of MBK Shares to GEMC and sole funding expenditure of AUD $2M; and

- Phase 4 – GEMC may elect to require MBK to buy out GEMC’s remaining 20% interest for shares in MBK at a value to be agreed, and failing such election, both parties are to fund expenditures in proportion to their respective interests.

The Term Sheet also includes a buy-out option at the end of Phase 2, allowing MBK to acquire an additional 29% (taking its total interest to 80%) for AUD $1.5M of MBK Shares and AUD $1M in cash, with the joint venture then proceeding immediately to Phase 4.

The terms of the Term Sheet are summarized in detail below.

Summary of Term Sheet

MBK has been granted a right of exclusivity from the date of the Term Sheet to 30 June 2021 in consideration of the payment of AUD $10,000 to GEMC. The right of exclusivity will extend through the Option Period following signing of an Option Agreement.

During the initial period, MBK and GEMC will finalise an Option Agreement and detailed earn-in and joint venture terms.

MBK’s exclusive option to earn-in and joint venture the Project will commence upon signing the Option Agreement and payment of a further AUD $10,000 payment to GEMC, and will continue for a term of 6 months (Option Period).

During the Option Period MBK will complete the Phase 1 Work Program described below.

On or before expiry of the Option Period, MBK may give notice to GEMC exercising the exclusive Option to earn-in and joint venture the Project and move to Phase 2.

If MBK does not exercise the option then the agreement is at an end.

At the commencement of Phase 2, MBK issue the equivalent of AUD $250,000 in MBK shares to GEMC and MBK will sole fund exploration expenditure of AUD $1M on the Phase 2 Work Program described below to earn a 51% interest in the project.

Upon completing its Phase 2 expenditure commitment, MBK may:

- elect to earn the 51% interest and either:

- form the joint venture and move to Phase 3;

- give notice to buy-out 29% of GEMC’s remaining interest, with BMK taking an 80% interest in the project in consideration of the payment by MBK of AUD $1M and issue of AUD $1M of MBK shares to GEMC. In the event such notice is give the joint venture will be formed on an 80% MBK, 20% GEMC basis; or

- withdraw without earning any interest.

At the commencement of Phase 3, MBK issue the equivalent of AUD $350,000 in MBK shares to GEMC and a Joint Venture will be formed with MBK sole funding and managing. During Phase 3, MBK will sole fund exploration expenditure of AUD $2M on the Phase 3 Work Program described below to earn an additional 29% interest in the project, taking MBK’s total interest to 80%.

Upon MBK completing its Phase 3 expenditure commitment and moving to an 80% interest, EMA may elect to require MBK to buy out EMA’s remaining 20% interest for shares in MBK at a value to be agreed.

If EMA does not make this election, both parties will jointly fund exploration, feasibility and development expenditure in their proportionate shares, with each parties’ interest diluted in accordance with a standard industry dilution formula should either MBK or GEMC not contribute.

Proposed MBK Option, Earn-in and JV Work Programs

Note: Work programs are indicative and may change subject to exploration results.

Phase 1 – Option Period

- detailed geological mapping

- infill pXRF soil survey (25m spacing) and mapping to refine drilling locations

- reconnaissance drilling up to 4 reverse circulation (“RC”) holes (2 section lines) for up to 500m at Millennium North

Phase 2 - Earn-in – Resource and exploration drilling

- Millennium Resource

- 2 x deep down dip extension test holes – for 600m (RC/DD)

- 6 x resource infill holes – for 900m (RC/DD)

- Millennium North

- 14 holes on 7 section lines at 100m spacing – 2,800m (RC)

- Federal/Corella Trend

- early reconnaissance exploration - up to 4 x RC holes for up to 600m (RC)

Phase 3 - Joint Venture – Resource upgrade and commencement of feasibility study

- Millennium Resource upgrade (drill-out) – up to 2,500m Diamond drilling

- Update Mineral Resource Estimate

- Commencement of feasibility study

Phase 4 – Joint Venture

- Completion of bankable feasibility study

- Development approvals

- Development

- Mining

The Millennium Project

The Millennium Project is a significant advanced copper-cobalt-gold project with a large defined zone of copper-cobalt mineralisation that remains open for expansion at depth and along strike. Copper-cobalt mineralisation is associated with shear zones hosted within a sequence of volcanic and sedimentary units.

The Millennium Project is strategically located on granted mining leases, less than 20 km from the Rocklands mine site and processing facility and within the economic and infrastructure hub of Mount Isa, Queensland. The Mt. Isa Mineral Province is recognized as a world-class mining region, with more than a quarter of the world’s lead and zinc reserves, 5% of the world’s silver resources and 1.5% of the world’s copper resources.

In 2017 and 2018, GEMC conducted a 10-hole, 1,141 metre drilling campaign on the Millennium Project to test the up-dip continuity at the Millennium North deposit and confirm historical estimates of cobalt mineralization reported in 2016 by Hammer Metals. The program was successful in both duplicating historical results, demonstrating the continuity of mineralisation within the mineralised zone and in determining mineralisation continues to depth, including 28m @0.35% Cu and 0.2% Co (MIRC026). Significantly, cobalt and copper mineralisation was encountered along the entire targeted 1,500 metre strike length with the zones remaining open in all directions.

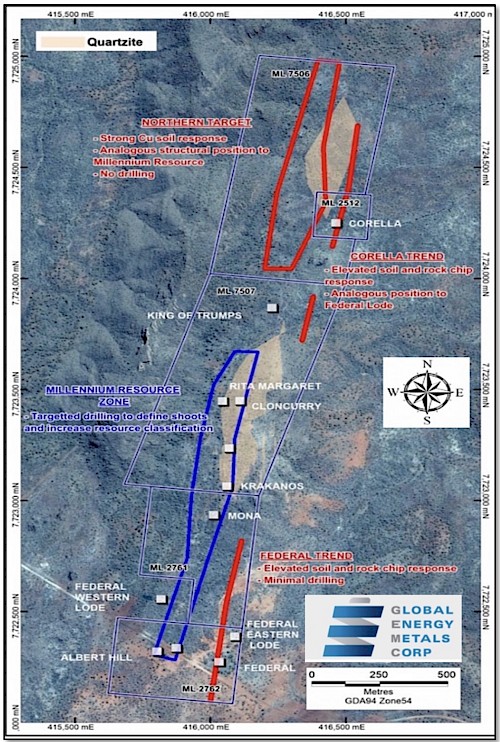

Mapping, soil geochemistry and rock sampling conducted by GEMC identified an additional 1.5 km of anomalous cobalt-copper mineralisation in geological analogues that occur along a potential strike extension in the northern half of the tenement package (“Northern Extension”). This area has no previous drilling to date and provides an excellent opportunity to increase the overall resource potential of the Millennium Project. The Millennium mining leases also include the Corella and Federal prospects, along a parallel zone of significant surface Cu-Co-Au anomalism and historical workings, that are untested by drilling and provide yet further potential to grow the resource base (Figure 1).

Figure 1. Map showing existing Millennium resource zone and exploration targets

Rock chip sampling was also conducted by GEMC to test for additional zones of cobalt and copper mineralisation along the Millennium trend and in particular the Northern Extension where similar host rock units and strong soil geochemical anomalies are located. This zone is located approximately 1 kilometre north of the current Millennium Resource as defined. The continuation of elevated soil arsenic and copper geochemistry and presence of anomalous cobalt and copper in rock chip samples and analogous geology between the Millennium Resource area and the Northern Extension indicate that this area is a priority target for further investigation.

GEMC also conducted initial metallurgical testwork on the Millennium Project in 2018, reporting cobalt and copper recoveries exceeding 95%.

Fore more information on the Millennium Project please refer to the Company’s website: https://www.globalenergymetals.com/projects/millennium-cobalt-project/

Metal Bank Limited

Metal Bank Limited is an ASX-listed minerals exploration company (ASX:MBK).

Metal Bank’s core focus is creating value through a combination of exploration success and quality project acquisition. The company’s key projects are the 8 Mile and Eidsvold gold projects situated in the northern New England Fold Belt of central Queensland, which also hosts the Cracow (3 Moz Au), Mt Rawdon (2 Moz Au), Mt Morgan (8 Moz Au, 0.4Mt Cu) and Gympie (5 Moz Au) gold deposits. The projects are both associated with historical goldfields and represent intrusion related gold systems (IRGS) with multi-million-ounce upside.

The Company has an experienced Board and management team which brings regional knowledge, expertise in early stage exploration and project development, relevant experience in the mid cap ASX-listed resource sector and a focus on sound corporate governance.

The Company is committed to a strategy of diversification and growth through identification of new exploration opportunities which complement its existing portfolio and pursuit of other opportunities to diversify the Company’s assets through acquisition of advanced projects or cash-flow generating assets to assist with funding of the exploration portfolio.

In pursuit of this strategy, the Company is actively reviewing new opportunities within Australia with a number of third parties under confidentiality arrangements. In addition, the Company is continuing to work with government and stakeholders in the MENA region with a view to securing an advanced copper exploration project.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Global Energy Metals Corporation

(TSXV:GEMC | OTC:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believe the the time to be part of this electrification movement.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.