Vancouver, BC / TheNewswire / January 30, 2024 / Global Energy Metals Corporation TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”), a multi-jurisdictional, multi-commodity critical mineral exploration and development company focused on growth-oriented metal projects supporting the global transition to clean energy, is pleased to announce, subject to TSX Venture Exchange approval, that it has entered into a non-binding Letter of Intent (the “Agreement”) with the wholly owned subsidiary of Fulcrum Metals Plc, (“Fulcrum”) a company with shares that are quoted on the AIM market of the London Stock Exchange. Pursuant to the Agreement, Global Energy Metals will acquire an immediate 0.5% royalty on net smelter returns (the “NSR”) in Fulcrum’s Charlot-Neely, Fontaine Lake, Snowbird and South Pendleton uranium projects (collectively the “Projects”) located in Saskatchewan, Canada. GEMC will also be granted an option to acquire a 19.9% interest in the Projects as more particularly described below. Some of the Projects are owned 100% by Fulcrum (the “Owned Projects”), and others are optioned by Fulcrum (the “Optioned Projects”), which has obtained the consent of the optionor to the assignment of the option to GEMC.

Highlights:

- Located in proximity to the rim of the Athabasca Basin (“Basin”), Saskatchewan, a premium mining district and leading global source of high-grade uranium.

- High grade uranium samples of up to 6.22% at Charlot-Neely and up to 1.44% at Fontaine-Lake along with anomalous rare earth samples.

- Historical work at the projects has demonstrated evidence of uranium mineralization along favourable structural trends.

- Future exploration requires the undertaking of a modern systematic geologic evaluation to determine the resource potential.

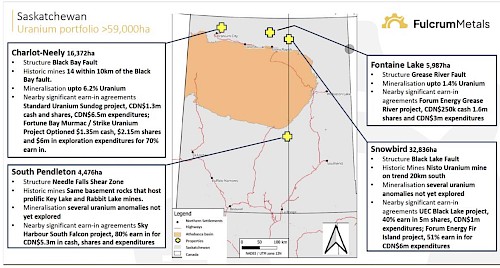

The Projects include mineral claims totaling over 59,000 hectares located along the margin of the Athabasca Basin. The Projects have potential for high-grade basement-hosted uranium deposits in a geological setting similar to other major discoveries on the Basin margin. This potential has been confirmed through initial exploration and evaluation by Fulcrum in 2023. A significant number of high-grade uranium showings occur within the Projects in addition to historical small-scale uranium mining.

Mitchell Smith, CEO & Director comments:

“In a world transitioning towards cleaner and greener energy solutions, one element takes center stage: uranium. This is a right time, right jurisdiction, right commodity scenario that aligns Global Energy Metals with uranium’s pivotal role in the global energy landscape.

Taking a non-operating interest option and royalty on a highly prospective portfolio of Canadian uranium assets fits well with Global Energy Metals’ ongoing strategy of providing our investors investment exposure to new energy metals critical to an electrified future.

Working with Fulcrum, Global Energy will further evaluate options for the projects including the securing of a strategic operational partner to apply their technical and jurisdictional expertise to advance these North American uranium projects at a such a critical time in the nuclear power sector.

We look forward to this collaboration with Fulcrum and are encouraged by the addition of a new commodity to Global Energy’s existing project, equity and royalty portfolio.”

Ryan Mee, CEO and Director of Fulcrum Metals also commented:

“The option of Fulcrum’s uranium portfolio by Global Energy provides positive leverage to all shareholders. Through the monetization of these uranium assets it provides immediate exposure to GEMC’s very active and exciting battery mineral, equity and royalty portfolio.

We are keen to work with GEMC to further delineate value for these projects at a time when demand for the commodity has been picking up globally as countries focus on transitioning to cleaner sources of energy.”

KEY TERMS OF ACQUISITION

On closing of the transaction, Global will acquire the NSR and a two year option (the “Option”) to acquire 19.9% of the Owned Projects and a 19.9% interest in the option agreement pertaining to the Optioned Projects (the “Option Agreement”). In consideration for the NSR and the two year option, GEMC will issue, subject to Exchange approval, five million shares at a deemed price of CAD $0.06 per share to Fulcrum. In order to exercise the option, GEMC will pay to Fulcrum $1M as a combination of cash and shares, as agreed to by both parties at that time, at a minimum deemed issue price (the “Floor Price”) equal to not less than the Discounted Market Price (as defined in policies of the Exchange) at the time a definitive agreement is announced by way of news release. If the Option remains unexercised on the one-year anniversary of entering into a definitive agreement, Fulcrum is entitled to $50,000 in cash and $125,000 in shares in GEMC at a deemed price per share equal to the Floor Price. Fulcrum will remain as operator of the Projects and will maintain and keep the Projects in good standing. Should GEMC elect to exercise its option it will be provided a carried individual interest on each project on expenditures until a NI 43-101 compliant Resource estimate (or other equivalent report (a “Report”) is established. Upon completion of a Report, GEMC will be responsible pro-rata to keep the projects in good standing upon exercising the Option. Once GEMC exercises the Option, for each resource delineated in accordance with NI 43-101 on a Property, GEMC will issue to Fulcrum $100,000 in GEMC Shares at a price per share equal to the greater of: (a) the Floor Price; and (b) a 20% premium to Volume Weighted Average Price of GEMC’s shares on the Exchange for a period of 5 days. Post Resource, on each project, GEMC can participate or be diluted down to 2% at which time its position will convert to another 0.5% NSR royalty.

The transaction contemplated above is a “Non-Arms’ Length” transaction in accordance with applicable securities legislation, as Mitchell Smith is a director of both GEMC and Fulcrum. Mr. Smith has declared his conflict to the boards of both companies, and abstained from voting on the transaction.

The TSXV has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release.

PROJECTS OVERVIEWS

The project portfolio totals over 59k hectares targeting major structures along strike from historic Uranium mines and projects that have attracted significant investment. Discoveries such as the Arrow discovery (4.3m tonnes at 0.83% U308 https://www.nexgenenergy.ca/exploration/overview/) and Triple R discovery (2.7m tonnes at 1.94% U308 https://fissionuranium.com/projects/triple-r-deposit/project-overview/) have proved the concept of exploring along structure outside of the Athabasca basin.

Charlot-Neely

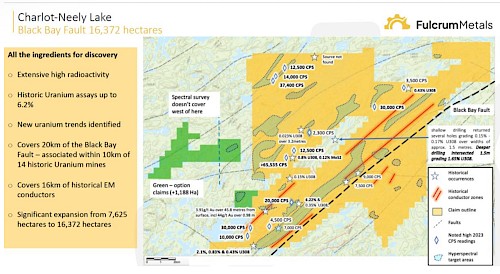

- Totalling 16,372 hectares located in Northern region of the Athabasca Basin along the Black Bay Fault.

- Covers 20km of the major Black Bay fault structure which is associated within 10km of 14 historic Uranium mines of the established Beaverlodge District includes over 16km of historical EM conductors.

- Several historical uranium showings with grab samples up to 6.22% and trenching samples up to 0.15%.

- The Property contains vein-hosted uranium mineralisation characteristics of the Beaverlodge area with potential for unconformity-style mineralisation at depth - unconformity deposits are known to be larger and contain higher uranium grades.

- Extensive radioactivity throughout the property including new radioactive hotspots identified in 2023 located along and near structural lineaments is attributed to shear-hosted and vein-type uranium mineralisation.

- The presence of off-scale radiation (>65,535 counts per second “cps”), yellow, U-oxide-stained fractures with sub-one percent uranium, and strong hematite alteration is considered typical of structurally-controlled uranium mineralisation.

- Sampling in 2023 returned numerous anomalous uranium samples including over 5,510ppm U and scintillometer measurements of >65,535 cps at the historical Peacock showing.

- Sampling exhibits strong hematite alteration along fracture planes and contain alteration overprinting the original rock enriching the sample in finely disseminated uranium - visible yellow uranium oxides are present.

- The radioactive zone is spatially associated with a large quartz vein and paragneiss/altered pegmatite veining.

- Evidence of strong deformation, proximity to a major fault (Long Lake Fault), and strong alteration signatures make this a target location for hydrothermal, vein-type uranium mineralisation.

- Additional recommended work includes prospecting, EM and Magnetic geophysical surveys, geochemical surveys and geological mapping of key showings to advance the project to drill ready stage.

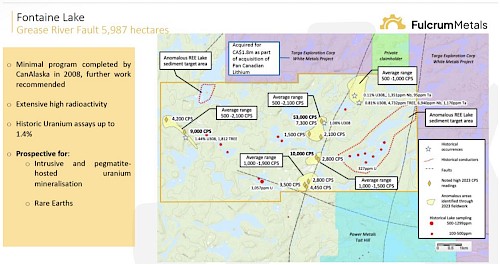

Fontaine Lake

- Covers 5,987 hectares located in the Grease River area, northeast of Lake Athabasca.

- Several historical uranium sowings of up to 1.44% uranium along with rare earth samples of up to 4,732ppm TREE, 6,940ppm Nb and 1,170ppm Ta

- 2023 sampling returned scintillometer readings up to 53,000 cps and 7,130ppm U by laboratory assay.

- The Property contains known vein-hosted uranium mineralization in addition to anomalously radioactive granites (Alaskite-type) generally characteristic of low-grade high-tonnage deposits, comparable to the geological setting of the Rossing deposit in Namibia.

- Given the large volume of the radioactive granites on and near the property, these rocks are candidates to explain the strongly elevated uranium values observed in the regional lake sediment sample data.

- Further work recommendations include prospecting to follow up on unexplored radiometric highs to confirm sources of radioactivity which may be masked by radioactive granites; gridded outcrop sampling over strongly radioactive zones in the granite to determine the potential for Alaskite-type mineralization on the Property; and soil or radon geochemical surveys to help delineate prospective structures related to high grade, vein type mineralisation.

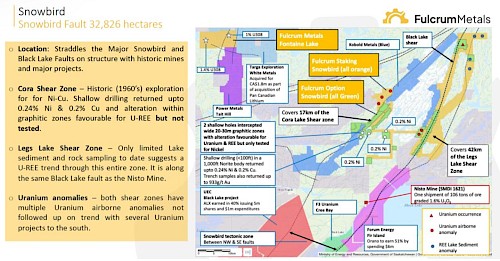

Snowbird

- The project covers 32,836 hectares of the largely underexplored Cora Lake and Legs Lake Shear zones between major NE and SW Snowbird faults and the Black Lake Fault, Northern Saskatchewan.

- The Black Lake structure can be traced for at least 200km across the entire Athabasca Basin and is associated with the Centennial deposit.

- The project is on trend with the Historic Nisto Uranium Mine and notable projects Fir Island held by Forum Energy, Cree Bay held by F3 Uranium, projects held by Kobald Metals, the Black Lake project held by UEC and recent staking by Dennison Mines.

- Mining first occurred at the Nisto Uranium Mine in 1950-51. In 1959, Haymac Mines restarted mining and shipped 500 tons of high-graded ore to the Lorado Mill at Uranium City, SK. One shipment of 106 tons of ore graded 1.6% U3O8 (Source: Saskatchewan Mineral Deposits Index, Mineral Property #1621).

- Limited historic airborne surveys include Uranium airborne anomalies that have not been followed up on.

- Limited Lake sediment surveys identified a number of highly prospective REE targets and limited rock sampling identified the Bompas lake uranium occurrence suggesting a significantly wide zone of anomalous mineralisation for which the source of the anomalies had not been identified.

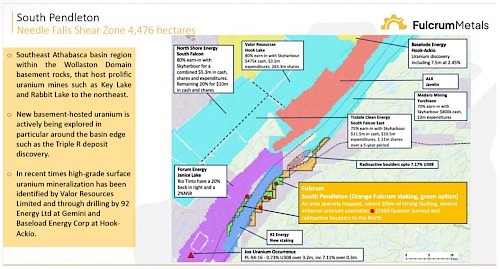

South Pendleton

- The project covers 4,115 hectares of the Needles Fall shear Zone, south of the Athabasca basin

- Under-explored area that is sparsely mapped.

- Covers 20km of major faulting.

- Several airborne Uranium squared anomalies are within the property that are yet to be followed up on.

- Radioactive boulders of up to 7.17% U308 to the North.

- In an area that is seeing substantial investment and development.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. He is a shareholder and Director of the Company.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believes Now is the Time to be part of this electrification movement.

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.