Vancouver, BC / TheNewswire / February 4, 2025 / Global Energy Metals Corporation TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”), a multi-jurisdictional, multi-commodity critical mineral exploration and development company focused on growth-oriented metal projects supporting the global transition to clean energy, is pleased to announce, subject to TSX Venture Exchange approval, that it has entered into a non-binding Letter of Intent (the “Agreement”) with NeoLithica Ltd. (“NeoLithica”) to acquire an eighteen month option to acquire a 19.9% interest and a 1% Net Smelter Return (“NSR”) royalty over NeoLithica’s Peace River Lithium Project (the “Project”).

NeoLithica is an emerging lithium resource development company that plans to incorporate innovative direct lithium extraction (“DLE”) and refining technologies to produce battery-grade lithium compounds in support of Canada’s critical mineral supply chain. The Company is headquartered in Calgary, Alberta.

HIGHLIGHTS:

- The global push for decarbonisation has placed lithium at the forefront of the clean energy transition with lithium brine projects emerging as a promising solution to meet the growing demand for battery-grade lithium while enhancing energy independence amid rising geopolitical uncertainties.

- The lithium mining market is projected to grow from $10.96B in 2024 to $29.5B by 2032, fuelled by a 13.18% CAGR during the forecast period.

- NeoLithica has assembled a large contiguous mineral tenure position in Alberta’s Peace region that features well developed production infrastructure.

- NeoLithica completed its National Instrument 43-101 (“NI 43-101”) Technical Report, which includes an inferred mineral resource estimate of 10 million tonnes of lithium carbonate equivalent (LCE), at an average grade of 70.0 mg/L.

- On closing of the transaction, Global Energy will be granted an eighteen month option to acquire 19.9% in and a 1% NSR royalty over NeoLithica’s Peace River Lithium Project.

- In consideration for the NSR and the eighteen month option, GEMC will issue, subject to Exchange approval, two million shares at a deemed price of CAD $0.05 per share to NeoLithica and pay immediately $10,000 in cash.

- In order to exercise the option, GEMC will, by the eighteenth month, pay to NeoLithica $1.5M as a combination of cash and shares, as agreed to by both parties at that time, at a minimum deemed issue price.

- NeoLithica will remain as operator of the Project and will maintain and keep the Project in good standing.

- Working with NeoLithica, Global Energy will further evaluate options for the project including the securing of a strategic operational partner to apply their technical and jurisdictional expertise to advance this key North American lithium project and solidifying the Project’s role in Canada's critical minerals supply chain.

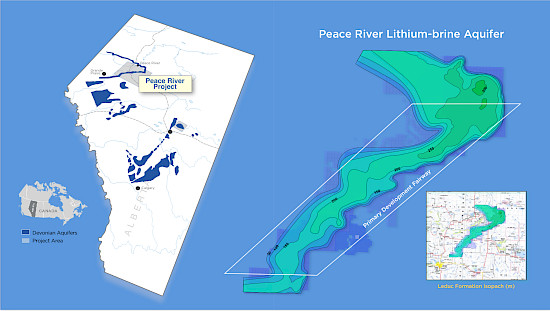

Pursuant to the Agreement, Global Energy Metals has secured an option to acquire (the “Option”) from NeoLithica within a eighteen (18) month period a 19.9% interest in and a 1% NSR royalty over NeoLithica’s Peace River Lithium Project. The Project is located in the Peace River region of northwest Alberta and features 377,508 hectares (1,458 square miles) of prime lithium-brine hosted mineral licenses overlying several highly productive lithium-rich aquifers that stretch along a 165 kilometre fairway and hosts an inferred mineral resource estimate of 10 million tonnes of lithium carbonate equivalent (LCE), at an average grade of 70.0 mg/L. Please refer to the NI 43-101 compliant resource estimate hosted on the NeoLithica website.

Mitchell Smith, CEO & Director comments:

“The accelerated global shift towards clean energy solutions continues to shine a spotlight on sustainable and cost-effective mineral extraction methods, and lithium brine projects are emerging as a promising solution to meet the growing demand for battery-grade lithium while enhancing energy independence amid rising geopolitical uncertainties.

Taking a non-operating interest option and royalty on a highly prospective lithium brine asset offers excellent optionality against a realistic current background of depressed lithium pricing and global cost inflation. We see Peace River as an important Canadian project that has the potential to be a strategic source of lithium as the global supply chain rebalances over time, driven by the growing criticality of locally sourced, ethically produced lithium needed to support the energy transition.

We look forward to this collaboration with NeoLithica and are encouraged by the addition of a promising lithium asset to Global Energy’s existing project, equity and royalty portfolio that provides our shareholders investment exposure to new energy metals critical to an electrified future.”

Barry Caplan, President of NeoLithica comments:

“Global energy will be a valuable partner and help evaluate options for NeoLithica and work with us in securing a strategic operational partner to apply their technical and jurisdictional expertise to advance this North American lithium project when demand for lithium surges, driven primarily by the electric vehicle revolution and the growing need for renewable energy storage systems.”

KEY TERMS OF ACQUISITION

As consideration for the Acquisition, GEMC will secure the option my making an immediate non-refundable cash payment of CAD $10,000 to be used for testing of brine from the Project and, upon TSX Venture Exchange (the “TSXV”) approval (the “Effective Date”), issuing CAD $100,000 of common shares in the capital of GEMC (the "Payment Shares") at a deemed value of $0.05/share for a total of 2,000,000 shares in GEMC.

If the Option remains unexercised on the twelve-month anniversary of the Effective Date, NeoLithica is entitled to a cash payment of CAD $100,000.

The option to acquire is exercisable at GEMC’s election on or before the eighteenth (18) month anniversary of the Effective Date, for additional consideration of CAD $250,000 cash payment and, at GEMC’s discretion, CAD $1,250,000 in cash and/or common shares of GEMC at the greater of i) the 5-day volume weighted average price one business day prior to the date that the TSXV provides approval of the exercising of the Option; or ii) at a deemed floor value of $0.075/share.

The transaction contemplated above is a “Non-Arms’ Length” transaction in accordance with applicable securities legislation, as Mitchell Smith is a director of both GEMC and NeoLithica. Mr. Smith has declared his conflict to the boards of both companies, and abstained from voting on the transaction.

The TSXV has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release.

PROJECT OVERVIEW

The Peace River Project features thick, extensive, and highly-productive lithium-brine aquifers associated with carbonate reef buildups in the Leduc Formation of the Devonian Woodbend Group. Access to the Leduc Formation aquifer brine at the Peace River property will be undertaken by drilling and completing wells to pump the brine from depths of approximately 2,250 m. Once the lithium is extracted, the brine will be injected back down into an overlying porous aquifer.

The Peace River Project consists of 50 contiguous lithium-brine hosted licenses issued by the Alberta Energy Ministry that overlie the thick Leduc Formation fringing reef, and overlying Wabamun Formation that were deposited in a shallow inland sea along the emergent Peace River Arch. All permits are held 100% by NeoLithica Ltd. and currently the Project is comprised of a total area of 377,508 hectares (1,458 square miles).

The Wabamun Formation, that overlies the Leduc, is also a potential source of lithium-brine with similar chemistry as the Leduc and may be added to NeoLithica’s NI 43-101 resource estimation in the near future.

NeoLithica’s permits lie on the eastern flank of the Peace River Arch, a prominent basement structure that controlled the location and massive growth of the porous brine-filled carbonate reefs during the Devonian period.

The thick and widespread Woodbend reefs that fringe the Peace River Arch, and the underlying Beaverhill Lake platform carbonates have produced large volumes of oil and gas, in addition to massive amounts of formation water (brine). These stacked lithium-rich aquifers reach up to 300 metres in thickness.

After separation of the produced oil and gas from the formation waters (brine), the lithium-voided brine is disposed of by re-injecting it back into an overlying formation, which avoids diluting the lithium concentration in the primary producing zones.

NeoLithica has conducted a detailed geologic study within its project area, which served as the foundation for its National Instrument 43-101 technical report.

Figure 1. The Peace Region in Alberta is home to significant oil and gas production and well developed infrastructure that can be leveraged to accelerate commercial lithium development.

NeoLithica has developed a two-stage pre-commercialization plan designed to rapidly place the company on the global stage as a sustainable producer of this critical electric metal extracted from brine in Alberta’s oil and gas reservoirs.

The first stage of pre-commercial development was completed in 2023, and comprised resource definition and NI 43-101 compliance reporting, refining the database of existing well and pipeline infrastructure, expanding the company’s mineral tenure, environmental scoping and stakeholder consultations.

NeoLithica plans to commission a Preliminary Economic Assessment (PEA) after conducting several demonstration pilots in early 2025, and upgrade the extracted lithium concentrate to produce battery-grade lithium compounds to seed to potential global buyers.

The third stage of development will be focused on drilling up to two brine wells in 2025 to perform reservoir engineering evaluations to determine the ultimate producibility of the Wabamum, Leduc and Granite Walsh formations, and the injectivity of the overlying Belloy Formation. The wells will also provide the source of brine needed to conduct a pre-commercial demonstration pilot to determine the most effective way to integrate its selected DLE platform within an optimized brine production infrastructure. After the scaled demonstration program is completed, NeoLithica will develop its aquifer management plan and commission a Pre-feasibility Study (PFS).

The results of the above project development, conducted by the team at NeoLithica, its technology partners and industry experts, will de-risk the Peace River Lithium Project and lead to Final Investment Decision.

Global Energy is relying on the information provided by NeoLithica Ltd.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. He is a shareholder and Director of the Company.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believes Now is the Time to be part of this electrification movement.

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.